Investing can be a great way to make your money work for you, but it can be intimidating for those who don’t know where to start. There are many different types of investments available, each with its own set of benefits and drawbacks. In this article, we will explore the different types of investments and their pros and cons so that you can make an informed decision about which type of investment is right for you.

Types of Investment Options

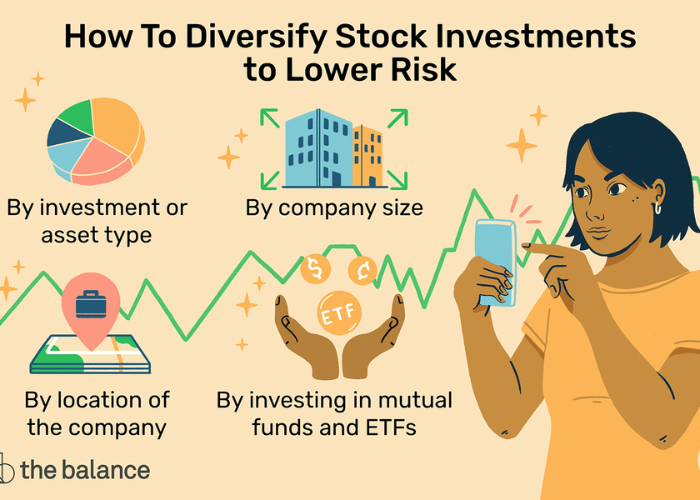

When it comes to investing, there are many different options available. Some of the most common include stocks, bonds, mutual funds, ETFs, real estate, private equity, high-yield savings accounts, commodities, and cryptocurrency. Each of these investment types comes with its own unique advantages and disadvantages, so it’s important to understand the pros and cons of each before making an investment decision.

Stocks and Bonds

Stocks and bonds are two of the most common and popular types of investments. Stocks represent ownership in a company and can provide investors with the potential for capital gains, dividends, and other forms of income. Bonds are a type of loan, in which the issuer agrees to pay back the principal plus interest to the bondholder. Stocks and bonds can provide investors with a steady stream of income, but they also come with some risks, such as the potential for loss of principal and fluctuating interest rates.

Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) are popular investment options for those who are looking for a more diversified portfolio. Mutual funds are a type of pooled investment that is professionally managed and invests in a variety of assets, such as stocks, bonds, and commodities. ETFs are similar to mutual funds, but they are traded on an exchange, making them more liquid and easier to buy and sell. Both mutual funds and ETFs can provide investors with a diversified portfolio, but they come with some associated fees and risks.

Real Estate

Real estate investing is a popular option for those looking to diversify their portfolios. Real estate investments can provide investors with the potential for capital appreciation and rental income. Investing in real estate can also provide a hedge against inflation, as real estate tends to rise in value over time. However, investing in real estate can be a risky proposition and requires a large amount of capital to get started.

Private Equity

Private equity is a type of investment that involves investing in a private company. Private equity investments can provide investors with the potential for high returns, but they also come with a high degree of risk. Private equity investments are usually illiquid, meaning that investors may have difficulty selling their shares if they need to access their money quickly.

High Yield Savings Accounts

High-yield savings accounts are a popular option for those looking for a safe and secure investment with a guaranteed return. High-yield savings accounts offer a higher return than traditional savings accounts and are FDIC-insured, meaning that your money is protected up to a certain amount. While high-yield savings accounts are safe and secure, they typically offer lower returns than other types of investments.

Commodities

Commodities are physical goods such as oil, wheat, gold, and silver that are traded on exchanges. Commodity investments can provide investors with the potential for high returns, but they also come with a high degree of risk. Commodity investments are highly volatile and can be affected by changes in the global economy, political unrest, and other factors.

Cryptocurrency

Cryptocurrency is a type of digital currency that is based on a decentralized network of computers. Cryptocurrency has become a popular investment option due to its potential for high returns, but it also comes with a high degree of risk. Cryptocurrency investments are highly volatile and can be affected by changes in technology, government regulations, and other factors.

Conclusion

Investing can be a great way to make your money work for you, but it is important to understand the pros and cons of each type of investment before making a decision. Stocks and bonds are two of the most common types of investments, but there are also other options such as mutual funds, ETFs, real estate, private equity, high yield savings accounts, commodities, and cryptocurrency. Each of these investments come with their own unique advantages and disadvantages, so it’s important to do your research and make an informed decision about which type of investment is right for you.

Related posts

Recent Posts

InformalNewz: A New Era of Unconventional News Reporting

In the ever-evolving landscape of media and journalism, new platforms and approaches are constantly emerging to meet the demands of…

Balanced Living: Strategies for Achieving Wellness in a Hectic World

In today’s fast-paced world, achieving a sense of balance can often feel like an elusive goal. Juggling work, family, social…