Credit scores are an important part of financial health. They are used to determine eligibility for loans, credit cards, mortgages, and more. Credit scores are a snapshot of a person’s financial habits and can be used to judge how well someone manages their money. While there is no one-size-fits-all approach to building and maintaining good credit scores, there are certain steps that can help. In this article, we will discuss the role of credit scores in financial health and provide tips on how to build and maintain good credit scores.

What is a Credit Score?

A credit score is a numerical representation of a person’s creditworthiness. It is calculated by a credit bureau using information from a person’s credit report. It is used by lenders to determine how likely a person is to pay back a loan or other type of credit. Generally, the higher the credit score, the more likely a person is to be approved for credit.

Benefits of Good Credit Scores

Good credit scores have many benefits. They can make it easier to get approved for loans, credit cards, and mortgages. Good credit scores can also lead to lower interest rates and better terms on loans. This can help save money in the long run. Good credit scores can also lead to lower insurance premiums, which can save money on monthly bills.

Tips for Building and Maintaining Good Credit Scores

Building and maintaining good credit scores can be a daunting task, but it doesn’t have to be. Here are some tips to help build and maintain good credit scores:

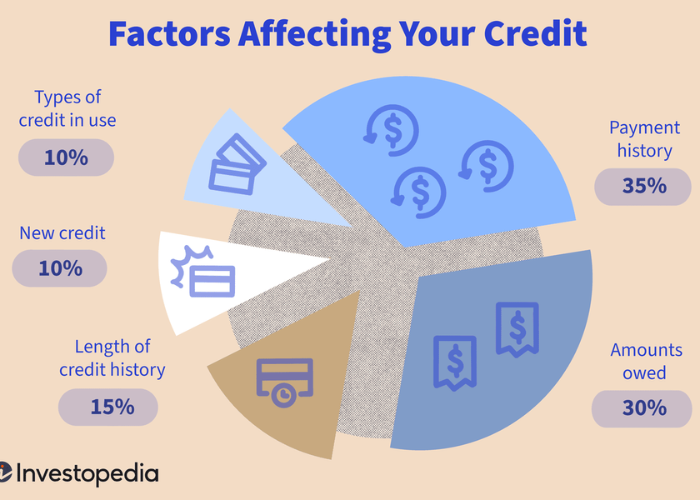

Pay bills on time: One of the most important things you can do to build and maintain good credit scores is to pay bills on time. Late payments can hurt a credit score and make it harder to get approved for credit.

Reduce credit card debt: High credit card balances can hurt a credit score, so it’s important to try to keep credit card debt low. Paying down credit card debt and limiting credit card purchases can help maintain good credit scores.

Monitor credit reports: It’s important to stay on top of your credit reports. Errors or inaccuracies on credit reports can hurt a credit score. Checking credit reports regularly can help ensure accurate information is being reported.

Don’t close unused credit accounts: Closing unused credit accounts can hurt a credit score. It’s best to keep credit accounts open, even if they are not being used.

Challenges of Improving Credit Scores Improving credit scores can be a challenge, especially if you have bad credit or are just starting to build credit. It can take time to build a good credit history and establish good credit habits. One of the main challenges of improving credit scores is staying disciplined and not falling back into bad credit habits.

Conclusion

Credit scores are an important part of financial health. They are used to determine eligibility for loans, credit cards, mortgages, and more. Building and maintaining good credit scores can be challenging, but it is possible. Following the tips above can help build and maintain good credit scores, which can lead to better terms on loans and lower insurance premiums. Improving credit scores takes time and discipline, but it can be done.

Related posts

Recent Posts

InformalNewz: A New Era of Unconventional News Reporting

In the ever-evolving landscape of media and journalism, new platforms and approaches are constantly emerging to meet the demands of…

Balanced Living: Strategies for Achieving Wellness in a Hectic World

In today’s fast-paced world, achieving a sense of balance can often feel like an elusive goal. Juggling work, family, social…